Portal - Consumer - Millennial Consumer

Executive Summary

- Millennial cannabis patients are ethnically diverse, well-educated and largely unmarried

- They are always connected, rarely making purchases without researching in advance

- Less brand loyal, instead favor convenience and ease of use and are allured by innovation

- 45% of millennials prefer edibles, far more than concentrates (20%) and flower (30%)

- Millennials spend almost $100 per week on cannabis and spend more per item than older generations

- Marketing strategies should focus on innovative ways to connect with the brand and encouraging positive, organic user reviews, social media posts and word-of-mouth advertising

There are many perceptions, both positive and negative, surrounding the Millennials; a generation of tech leaders, social media gurus, and commitment-phobes, constantly glued to their smart phones, the driving force behind the “sharing economy” and disruptive innovation, and so on and so forth. But whether one likes them or not, Millennials compose the largest generation in U.S. history, and given that they are still relatively young and will continue to dominate the population (and likely, the economy) for decades to come, every marketer, developer, manufacturer and vendor should be actively strategizing on how to sell to and win loyalty from this segment of the market. If sheer market size is not convincing enough, Millennials are also consuming cannabis with great frequency – nearly three-fourths of surveyed Millennial cannabis patients use at least 3 days per week, most of those every day – thus this generation is of particular relevance to cannabis companies.

Using the data from over 1,200 medical marijuana patients surveyed throughout California in 2016 – half of whom were Millennials – Brightfield Group has generated the profile below to characterize this demographic, their behaviors, attitudes, and what they seek in their cannabis. Marijuana businesses may utilize this information to effectively appeal to and gain the loyalty of a large and expanding market of Millennial cannabis patients.

Millennials: Who are they?

When it comes to demographic makeup, the Millennial medical cannabis patients represent quite a departure from the generations that preceded it. Millennials are much more ethnically diverse than Gen Xers and Baby Boomers, in particular because this cohort is made up of substantially more Hispanic and Latino consumers, especially among its youngest members. In fact, among 18 to 20 year olds, for the first time, Hispanic and Latino users in California outnumber Caucasian users - a trend we can expect to continue.

Millennials cannabis patients are very well educated and relatively well-off despite their youth – perhaps due to the amount of schooling they´ve attained, or because Californians under 35 are well represented in generously-paid tech and professional industries. They are largely unmarried, and their tendency to remain single or cohabitate is partially related to the fact that this is simply a younger cohort, but also has to do with the general trend among this demographic of deferring or altogether avoiding commitment, at both the personal level (e.g. marriage versus sharing living space) and the financial level (e.g. renting rather than owning).

Millennials: How do they live their lives?

It probably comes as no surprise that the data indicates Millennials are quite technologically savvy, especially with respect to social media and smart phone apps.

Nearly three-fourths of Millennial respondents believe that their smart phones make their lives easier, and can thus be reasonably expected to use these devices to many ends and with frequency. They are indeed turning to apps for a great number of things beyond social media, such as to help facilitate purchases and weed out poor-quality services and products. For example, approximately half of Millennials surveyed use Yelp and over one-fifth use Foursquare at least once per week to access product and service reviews before shopping or dining.

Apps such as these allow this generation to communicate like never before, and their information sharing helps ensure that users always know what to expect from a store or product. Using technology, Millennials can more easily avoid purchasing cannabis products or patronizing dispensaries with poor (or even less-than-ideal) reviews.

Given that smart phones are ubiquitous in California today, yesterday’s reality – in which customers often blindly shopped or may have been willing to attempt new products without confirming their quality first – no longer exists.

For long-term survival, dispensaries and manufacturers should begin turning their sights to the Millennial market, making it a priority to focus as much on quality, authenticity and reputation as they do on hitting growth targets. This is the generation of Facebook, viral videos, and storytelling – a generation not only receiving a constant flow of information, but becoming increasingly aware of inauthenticity and seeking more honesty in marketing and companies before committing funds to any purchase.

Quality and authenticity of product and service – rather than misleading or exaggerated advertising - signify great user reviews (online, through apps, and via word-of-mouth marketing), repeat customers, and clients who purchase in greater quantities and with more frequency. When it comes to marketing to this generation, offering quality goods and services is indeed worth the effort and investment required, and will pay off many times over in the long term.

- The Innovation Generation [10]

Millennials are a cohort of people that seek the new, the innovative - the “next big thing”. They are allured by the idea of trying new brands, with more than two-thirds of them indicating that they find this process enjoyable and exciting, and they are also prone to making impulse purchases. But as discussed above, the majority of Millennials will look for as much information as possible about a brand before purchasing, and are quite a bit more skeptical about buying from a brand they’ve never heard of than are other generations.

Brand loyalty often takes a back seat with this age group, coming in second to the newest products and stores that are the focus of attention of peer reviews and friends’ opinions. Millennials are not as connected or loyal to favorite brands, products, or stores, as their predecessors were – but they are constantly connected to the internet.

For these reasons, the massive Millennials market will be more allured by active and creative social media marketing campaigns that tie in innovative ideas and approaches, than it will by personal knowledge and trust of a brand, product or store.

Millennials live busy lives. They work hard, with about 30% working over 40 hours per week. They prefer convenience and expediency whenever possible, and make that preference evident with their purchasing habits. For example, twice as many Millennials (versus older generations) strongly prefer to purchase online than go to a brick-and-mortar store to make a purchase.

This generation is also more interested in health and fitness than generations prior, as indicated by their proclivity to bike short distances and follow diet regimens. However, there are a number of Millennials buying and consuming fast food extremely regularly – well over twice as many Millennials reported eating fast food 10 or more times per week (the equivalent of 1-2 times per day) than did respondents from other age groups. About a third of Millennials are eating out six or more times per week, a staggering number. What does all this mean, if health is indeed a greater priority for this group?

Convenience. Saving time and investing it on other priorities is seen as even more important than health or budget. Cannabis dispensaries, entrepreneurs and manufacturers seeking to increase their reach in this market should focus less on traditional marketing, which is less effective with Millennials, and instead utilize social media platforms, and develop or join apps that emphasize convenience (product delivery in particular).

Millennials: What marijuana products are they buying?

[14]Millennial cannabis patients are most interested in edibles of all sorts, baked goods in particular, as opposed to flower or concentrates. This cohort may be selecting edible items for discretion, as most of them are single or living with partners, and potentially have roommates or live with parents or children, and need to use cannabis medications that do not emit smoke or leave a mess behind.

There may also be a related social aspect – this young generation, enthused about networking and sharing, may be enjoying edible baked goods or snacks together with other patients, which is more practical with edibles.

Millennials: How much are they purchasing and consuming?

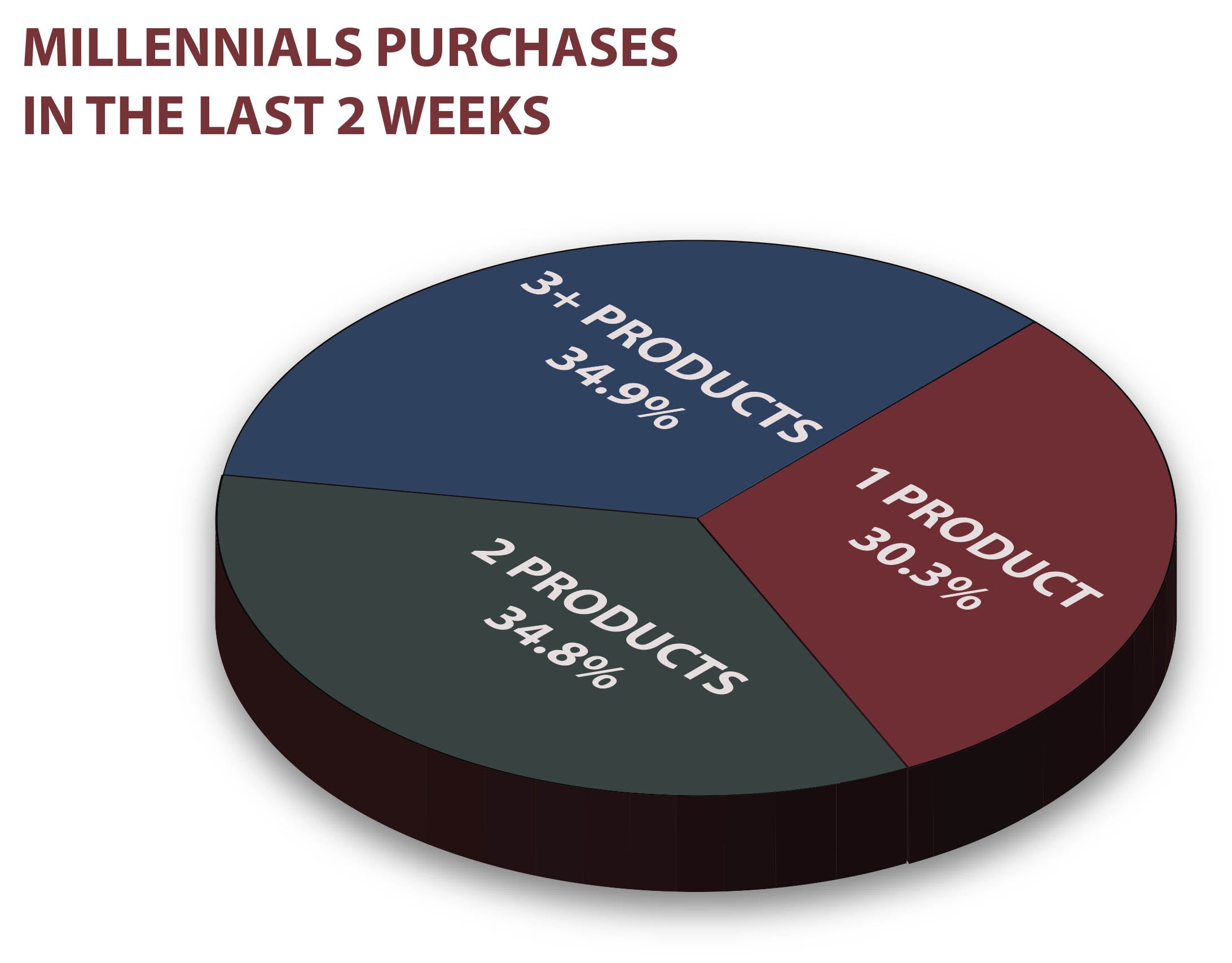

[15] [16] [17]While Millennials may be selective with their spending, this is a generation that is certainly not afraid to spend. They are spending 20% more on their weekly marijuana purchases than non-Millennials are. However, Millennial users are purchasing about the same number of cannabis products that older generations are, thus their higher spending corresponds with the more expensive goods being bought. The majority of Millennials are frequent users, with about three-fourths using marijuana products at least three days per week.

With a willingness to buy top-shelf products as well as great quantities, Millennials are spending a good deal on marijuana – upwards of $100 per person per week – thus each client gained from this cohort is valuable.

Millennials: What are they looking for when buying weed?

[18]As discussed, Millennials are greatly dependent on social networking to help inform their decisions, so they seek the opinions of family members and friends when looking to purchase new cannabis products – in fact, peer recommendations and reviews are typically their first draw to a product they haven’t tried before.

Besides validation from trusted and familiar sources, Millennials are looking for tasty, consistent products as well as discreet packaging and consumption methods. They do indeed value trusted brands and when not seeking innovative or new products, will purchase from a brand they know offers a quality experience. Thus all hope is not lost for companies seeking to tap into this market to gain regular, loyal customers.

Millennials: How can companies reach them?

- Product Development

Strategies that will keep Millennials (a.k.a. the Innovation Generation) interested over the long term must evolve over time, thus companies must push to produce innovative products, services, and ad campaigns whenever possible to draw in new customers and keep current clients content. Innovations targeting this edible-inclined demographic may be as simple as a new take on a common food – for instance, cannabis manufacturers have recently begun producing CBD chewing gum and individually handcrafted cannabis marshmallows. Alternatively, for the technologically inclined, more app-friendly or better-engineered products and methods for cannabis use can attract customers from this market as well – e.g. self-igniting pipes.

Millennials prioritize taste and dosage first in their marijuana products, but also highly value discretion, thus products developed should not only emphasize quality of flavor and buzz, but should also be simple to hide and consume inconspicuously. Some choice products might include smaller candies or savory snacks, or vape pens that double as some other product or tool.

- Packaging/Product Positioning

When Millennials spend a great deal to purchase top-shelf products, they expect quality and discretion in packaging. Manufacturers and vendors looking to target this generation should thus invest in packaging that is safe from children and prying eyes, even when this is not required or overseen by the government. This initiative will be recognized and appreciated by customers, and may distinguish brands from competitors.

Packaging is also an excellent way to make a product stand out and generate innovation with little investment – companies might reinvent packaging periodically to give products a “face lift”, and can also make transparency and quality evident through labeling and packaging by simply providing a company website and phone number, and a clear indication of ingredients and potency.

- Marketing/Distribution

It goes without saying that social media marketing campaigns, especially those that harness innovation, will be the most effective with this generation. However, it is important to be very attentive to the messages that are being conveyed through these campaigns. A Millennial who purchases a product advertised as one thing, and experiences something different and of dubious quality, is likely going to let this be known to his or her friends, colleagues, and everyone on the internet – certainly not a good look for a company looking to expand in this market. Conversely, if companies work actively to create great products - especially if they are available to be reviewed online – marketing will be much more positive, simple and straightforward, as products and services will essentially promote themselves via excellent reviews. Therefore, when customizing a strategy to appeal to this extremely communicative cohort of people, it is vitally important that companies work not only to stock consistently quality products, but to be authentic in marketing them as well.

As discussed, Millennials strongly favor purchasing online to visiting brick-and-mortar stores, therefore distribution plans targeting this demographic should be more focused on broadening the delivery radius for app or online purchases than generating a product or brand presence in more dispensaries. Companies providing deliveries should also be conscientious about keeping delivery times low, and order errors to a minimum - both common pitfalls of marijuana delivery services.

Notes

[1] Survey question: Please select which ethnicity applies to you. Responses available: Caucasian; Hispanic or Latino; Black or African American; Asian or Asian American; Middle Eastern; American Indian or Alaska Native; Native Hawaiian or Pacific Islander; Other; I prefer not to say.

[2] Survey question: Please indicate your current marital status. Responses available: Single; Living with partner; Married; Divorced or separated; Widowed.

[3] Survey question: What is your household income? Responses available: Unemployed; <$10,000; $10,000-$19,999; $20,000-$29,999; $30,000-$39,999; $40,000-$49,999; $50,000-$74,999; $75,000-$100,000; $1000,000-$150,000; >$150,000.

[4] Survey question: Please specify your gender. Responses available: Male; Female.

[5] Survey question: Please specify the highest level of education that you have attained. Responses available: Some High School; High School Diploma; Some 2 year college (Associates or Vocational Degree); Associates or Vocational Degree; Currently completing Bachelor Degree (B.A., B.S.); Bachelor’s Degree; Currently completing Graduate or Post Graduate Degree (Masters, PhD, Law, Medicine); Graduate or Post Graduate Degree (Masters, PhD, Law, Medicine).

[6] Survey question: Included in heading. Responses available: Strongly Agree, Agree, Neither Agree nor Disagree (omitted), Disagree, Strongly Disagree.

[7] Survey question: How often do you use the following apps? Responses available: Grid including options for frequency of use (Daily; 2-3 times per week; Weekly; Monthly; Less than monthly; Never; I have never heard of this app) for each of the following apps: Weedmaps or Leafly; Eaze; Same Day Online Delivery (ie. Amazon Prime Now, Google Express); Online Grocery Delivery (ie. Instacart, Amazon Fresh); Grub Hub; Yelp; Foursquare; Facebook; Instagram; Uber or Lyft.

[8] Survey question: Included in heading. Responses available: Strongly Agree, Agree, Neither Agree nor Disagree (omitted), Disagree, Strongly Disagree.

[9] Survey question: Please rank which app features or qualities are most important to you in this type of app. Responses available: Good user reviews; Security and confidentiality; Convenience and ease of use; Featured product quality; Featured product prices.

[10] Survey question: Included in heading. Responses available: Strongly Agree, Agree, Neither Agree nor Disagree (omitted), Disagree, Strongly Disagree. The same format was used for this and subsequent graphic.

[11] Survey question: Do you identify by any of the following? (Yes/No). Responses available: Vegetarian; Vegan; Gluten-Free; None of the above.

[12] Survey question: I bicycle to work as long as the ride is 5 miles or less. Responses available: Strongly disagree; Disagree; Somewhat disagree; Neither agree nor disagree (omitted); Somewhat agree; Agree; Strongly agree.

[13] Survey question: Last week, roughly how many times did you eat fast food (such as hamburgers, pizza, fried chicken, or burritos)? Response range available: 0 (Not at all) – 21 (Three times a day), in increments of one.

[14] Survey question: Please select one cannabis product that you have purchased in the past 2 weeks: Category. Responses available: Concentrates; Edibles; Flower; Other.

[15] Survey question: You will be asked the next set of questions for each different cannabis product that you have purchased in the past two weeks (up to four times). Please answer questions based on the product whose name is displayed in the question. How much did you spend on your most recent purchase of (product)? Response range available: $0 - $250, in $25 increments.

[16] Survey question: How often do you currently use or medicate using cannabis? Responses available: Every day; 5-6 days per week; 3-4 days per week; 1-2 days per week; 1-3 times per month; Less than once per month; Never.

[17] Survey question: How many different cannabis products have you purchased in the past 2 weeks? Responses available: 0; 1; 2; 3; 4+.

[18] Survey question: Why did you purchase (product) again? Responses available: I liked the taste; The dosage suited my needs/tolerance level; trust the brand to give me a consistent experience; It was the least expensive product of its type; It was the most discreet form of consumption; My friends purchase the same product; It is organic, while others are not; It is gluten free, while others are not; It is lab certified, while others are not; Other (Please Specify).